B2B Payments Rethinking The SME Loan Underwriting Model In Southeast Asia

March 10th, 2020 – The small business credit gap is a global issue, a problem that banks and FinTechs continue to hack away at, yet one that remains stubbornly persistent.

In markets like Southeast Asia, high rates of credit-invisible, underbanked small businesses make filling the small business credit gap an even more difficult challenge.

At the root of the matter is often a lack of predictive data to ascertain the creditworthiness of these small- to medium-sized businesses (SMBs). Traditional banks will require credit histories and collateral to underwrite a small business loan, both of which many SMBs in Southeast Asian nations lack. It’s a self-perpetuating scenario that keeps barriers to capital in place.

In a recent conversation with PYMNTS, Raghav Mathur, head of data science and analytics at Singapore-based Grab Financial Group, discussed the opportunities in data technology that can address the region’s most pressing SMB lending needs.

Written by Pymnts

Related Post

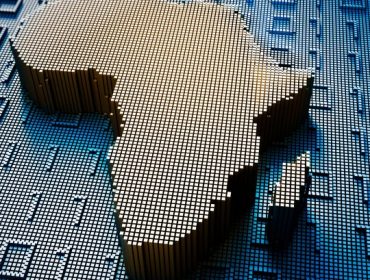

Digital Entrepreneurship in Africa

Africa’s progress in entrepreneurship, digital innovation, and its young population lays a solid foundation for achieving the United N...

Women, Business and the Law 2024:...

Women, Business and the Law 2024 This year’s report, the 10th in the series, finds that women worldwide continue to have fewer legal r...

European Commission launched AI innovation package...

On 24 January, the Commission has launched a package of measures to support European startups and SMEs in the development of trustworthy Art...